- 1y ·

-

Public·

-

social.network.europa.eu

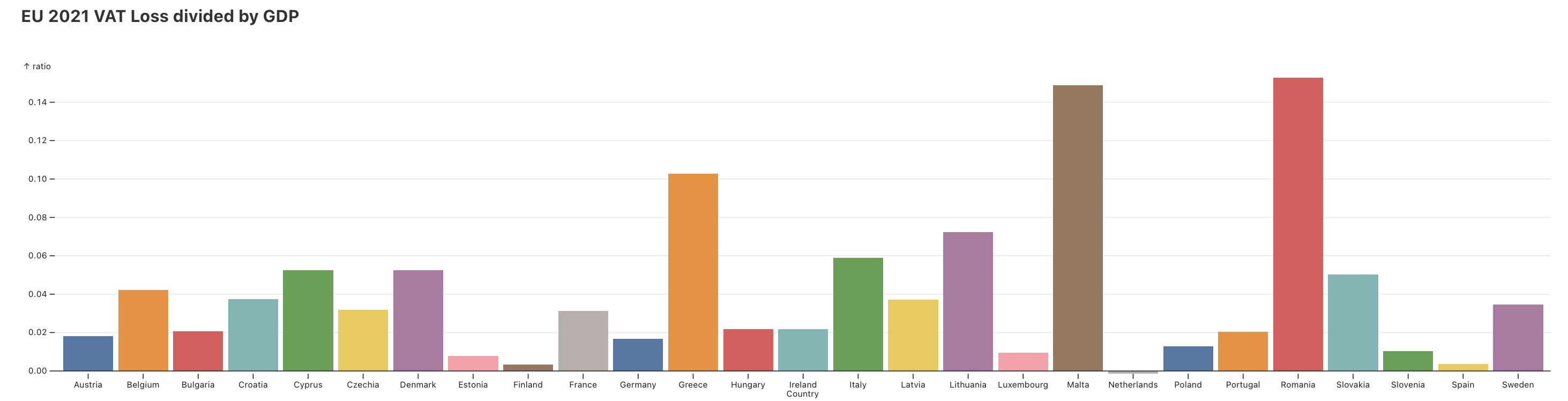

🇪🇺 €61 billion.

This is the amount of value-added tax (VAT) revenues lost in the #EU in 2021 mainly to fraud, evasion, non-fraudulent bankruptcies, miscalculations and financial insolvencies.

Yet, it is an improvement from the €99 billion lost in 2020.

Lost VAT revenues can severely hamper governments' ability to finance essential public goods and services, including schools, hospitals, and transportation.

We will continue to sustain and amplify efforts towards reinforcing VAT compliance.